INSURANCE IN RISK MANAGEMENT

Insurance is an important part of an integrated disaster preparedness strategy; this page provides an overview of insurance against extreme weather events and highlights the advantages and disadvantages of mandatory insurance for residential buildings in Germany.

© Nattanan Kanchanaprata, pixabay

overview

One consequence of ongoing climate change is the increase in extreme weather events such as droughts and heavy precipitation, both in frequency and intensity (IPCC 2021). In order to keep damage to a minimum, comprehensive disaster preparedness is indispensable, alongside climate protection and adaptation to the consequences of climate change that can no longer be avoided. The devastating storms with subsequent flooding in July 2021, which led to many fatalities (>180 people), and major material damage, especially in Rhineland-Palatinate and North Rhine-Westphalia (Fekete u. Sandholz 2021) , led to the social discourse on disaster risk management in Germany. In this context, (compulsory) insurance approaches were also increasingly discussed as part of risk management in relation to material damage (Schwarze 2021).

According to previous information from the German Insurance Association (GDV), cyclone “Bernd” caused insured losses of more than eight billion euros throughout Germany (GDV 2021a, last updated: 27.09.2022, further changes possible). However, the total damage is significantly higher and difficult to assess. 800 million euros in emergency aid was provided by the federal and state governments; a total of 30 billion euros is to be made available for the reconstruction of flood-damaged regions (Presse- und Informationsamt der Bundesregierung 2021).

Insurance against extreme weather events?

The importance of insurance in disaster prevention is internationally recognized. They are highlighted, for example, in the Sendai Framework for Disaster Risk Reduction 2015-2030 (UN 2015a). The resilience of the affected region and population is strengthened by the financial support of the insurance companies in the event of damage (ibid.). In addition, cooperation in and exchange on risk insurance is a component of the Paris climate agreement (Paris Agreement) (UN 2015b).

So-called climate risk insurance is used in the context of development cooperation and emergency aid (BMZ 2023). Germany is part of the „InsuResilience Global Partnership“, which promotes and financially supports various insurance approaches and models to protect against subsequent damage from extreme weather events (ibid.).

However, such insurance should not be understood as protection against “the climate” itself. According to Kreft und Kohler (2019) only climate-related extreme weather events can be insured.

Ex-Post and Ex-Ante

In humanitarian aid, it is not only financial support after an event (Ex-Post) that is of importance (Harris et al. 2019). Forecast-based financing (FBF) can also be used to take preventive action (Ex-Ante) on the basis of a scientific forecast of an extreme event, if a predefined threshold is exceeded (DRK, IFRC 2019). This allows, in line with disaster preparedness, procurement of supplies for humans and animals or early evacuations (ibid., Perez et al. 2015).

In the case of the 2020 flood events in Bangladesh, monetary amounts were disbursed ex-ante to the population (Pople et al. 2021). Through the United Nations World Food Programme (WFP), 23,000 households received about $50 each (ibid.). This strengthened food security during the events (ibid.). However, the extent to which this can constitute an insurance solution, and thus one that is contractually bound, is open to debate.

Nevertheless, the examples in the citations show that systematic financial preparedness before the occurrence of extreme events is also of great importance for the resilience of the affected population.

Even in Germany, it is possible to insure against the consequences of extreme weather events. Yet, the term “climate risk insurance” is not used here. Farmers can, for instance, arrange crop insurance to cover any yield losses and shortfalls. One way of minimizing the damage to crop production in the event of occurrence is crop damage insurance. In this case, the actual yield and, in some cases, quality damage to the insured crop is compensated (DLG e. V. 2018). Insurance coverage always includes the risk of hail and, depending on the type of crop, can be extended to include other risks such as storm, heavy rain and severe frost (ibid.). In relation to residential buildings, on the other hand, we speak of natural hazard insurance, which can be added as an additional clause to a classic residential buildings insurance policy or also household contents insurance (GDV).

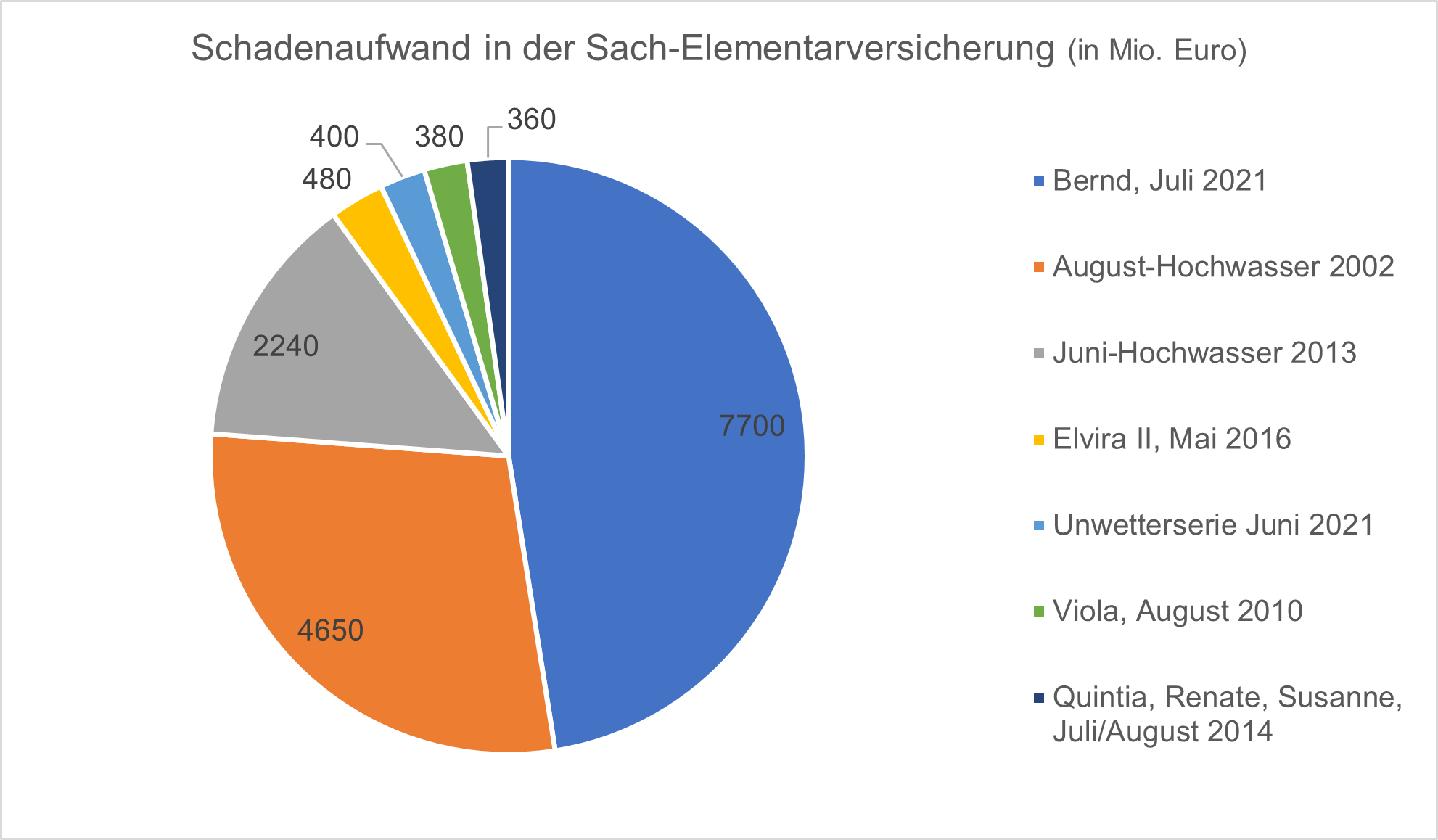

Figure 1: Shares of loss expenses in property elementary insurance of the most severe floods in their total loss (excluding motor vehicle claims) of about 16210 million euros. Extrapolation to inventory and prices 2020. Bernd 2021 & series of storms June 2021: preliminary figures, latter including motor vehicle damages. (Own presentation according to GDV 2021a u.2021b).

Insurance for homeowners

Conventional homeowners insurance covers not only damage caused by fire, but also damage caused by natural hazards such as windstorm and hail. (Netzwerk der Verbraucherzentralen 2022). With extended natural hazards insurance as a complementary insurance to residential building and/or household insurance, damage caused by heavy rain, floods, backwater, floods, avalanches, landslides, earthquakes and volcanic eruptions can also be insured (Groß et al. 2019). By May 2022, an average of 50% of all buildings in Germany are insured against natural hazards (GDV 2021b). According to the German Council of Consumer Experts (SVRV), one of the reasons for the low prevalence of natural hazard insurance is a lack of risk awareness among the population and politicians (Groß et al. 2019). This includes the building of basements or the inconsistency in building permits in flood risk areas (ibid.). Other factors for the low insurance density could also be a lack of trust in insurance companies or vague knowledge about the scope of one’s own insurance coverage (ibid.).

In view of the increase in extreme weather events due to climate change, the scientists emphasize in a policy brief the importance of comprehensive financial coverage through natural hazards insurance. However, comprehensive insurance against natural hazards is not yet mandatory in Germany. What criticisms are being discussed in this context and what would be the advantages of compulsory insurance?

Compulsory insurance for residential buildings?

What are the arguments against it?

The idea of mandatory insurance is not new. Demands for compulsory insurance also arose after the Elbe floods in 2002, which were met by politicians with a working group (Deutscher Bundestag 2009). After examining the proposal, compulsory insurance was rejected (ibid.). Even after renewed discussions in 2013 and 2015, mandatory insurance was rejected, citing the following reasons (Deutscher Bundestag 2016):

- Possible decrease in commitment of owners but also of the state to take preventive actions (e.g. flood protection of the building).

- Solvency of insurance companies

- Constitutional concerns: the obligation could restrict the fundamental rights of professional freedom of insurers and the freedom of action of private individuals. Likewise, the obligation must be reasonable, i.e., the occurrence of the risk would have to be likely for a large part of the insured persons.

- EU law concerns: possible distortions of competition or interference with European fundamental freedoms; natural hazard insurance serves to protect affected property owners and public finances, not injured third parties

- Financing of a reinsurance system (Deutscher Bundestag 2009)

In addition to the German Bundestag, the German Insurance Association (GDV) also opposes compulsory insurance for natural hazard damage and favors an overall concept that provides for preventive and protective measures in addition to an insurance solution (GDV 2022). GDV also sees this as an obstacle to preventive measures as well as problematic legal foundations (ibid.). According to the association, it is also possible for almost all property owners to obtain affordable insurance coverage. At the end of 2021, GDV presented a position paper advocating an “overall concept for climate change adaptation”, which includes an improvement of insurance coverage as a partial measure (GDV 2021c). Although a “mandatory solution” is also rejected here, new contracts with an integrated natural hazard clause, for example, and a so-called “Opt-Out Modell” (see below) with exemption from liability are to be introduced (ibid.).

What are the arguments for it?

Compared to the rest of Europe, Switzerland, for example, has 99% coverage of natural hazard insurance (read more here). But (how) could this also be achieved in Germany?

In Germany, insurance coverage against the consequences of natural hazards is only around 50 % and varies considerably depending on the federal state (GDV 2022). According to an investigation by the Rhineland-Palatinate consumer center in fall 2017, insurance coverage for some residential buildings is not possible or is linked to very high premiums (Verbraucherzentrale RLP 2020).

In theory, the Rhineland-Palatinate consumer center therefore advocates mandatory insurance on the basis of the following arguments (ibid.):

- In 2017, it was decided at a conference of state premiers that aid payments would only be provided if it was not possible for insurance to be obtained (e.g. Landesregierung RLP 2017, nrw o.J.).

- Low demand may mean that premiums are so high that only a few homeowners can afford appropriate insurance; costs could be reduced through compulsory insurance and an associated solidarity system (Verbraucherzentrale RLP 2020)

The German Bund der Versicherten (BdV) and the Verbraucherzentrale Sachsen (BdV 2016) as well as the SVRV also advocate mandatory insurance (Groß et al. 2019). This could increase the insurance density and thus represent a minimization of the financial damage caused by natural hazards (ibid.).

The consumer center sees a preliminary possibility to increase insurance coverage in Germany in the standard inclusion of a natural hazard clause in new contracts and contract amendments for residential building insurance, which must be actively rejected when the contract is concluded (so-called “Opt-Out Modell”) (Verbraucherzentrale RLP 2020). The results of a related study show, that the proportion of insurance companies that do not include such a clause as standard in contract conclusions predominates (ibid.).

Insurance models from other countries, e.g. Switzerland, could be used to improve the overall concept in Germany. But ultimately, insurance against natural hazards remains a part of risk management and supports the avoidance of consequential damage, but in no case replaces further preventive measures before and after the event of damage.

Created: June 2022; updated March 2023

More about the topic

information

DKKV-STATEMENT “VERPFLICHTENDE ELEMENTARSCHADENVERSICHERUNG”

sENDAI RAHMENWERK FÜR KATASTROPHENVORSORGE 2015-2030

Links

- In unserem Newsletter zu diesem Thema sprechen Andrea Heyer (Verbraucherzentrale Sachsen), Swenja Surminski (Grantham Research Institute for Climate Change and the Environment, London School of Economics) und Sönke Kreft (Munich Climate Insurance Initiative) über ihre Erfahrungen und Empfehlungen zur Versicherung gegen Naturgefahren. Zum Newsletter.

- Kreft u. Kohler: Climate Risk Insurance: From Policy to Practice, I-VW-HSG Trendmonitor, 3/2019.

- Policy Brief des Sachverständigenrats für Verbraucherfragen: Versicherungspflicht gegen Naturgefahren. Neue Entwicklungen, Verfassungskonformität und Akzeptanz in der Bevölkerung. Von Christian Groß, Gert Wagner und Barbara Leier, 2022. Veröffentlichungen des Sachverständigenrats für Verbraucherfragen.

- Positionspapier des GDV zur Zukunft der Versicherung gegen Naturgefahrenereignisse in Deutschland, 2021.

- Pressebeiträge zur Versicherungspflicht mit Kommentaren von Reimund Schwarze:

- Pflichtversicherung für Naturkatastrophen: Müssen immer Steuermillionen gezahlt werden? 1&1 News, Stand: 26.07.2021.

- Eine Reform der Katastrophenvorsorge ist überfällig. Tagesspiegel Background vom 21.07.2021.

- Nach der Flut: Wer zahlt für den Schaden? ARD Monitor vom 29.07.2021.

- Studie der Verbraucherzentrale Rheinland-Pfalz: Die Versicherbarkeit von Elementarschäden in der Wohngebäudeversicherung in Rheinland-Pfalz, 2020.

- Naturgefahren-Check des GDV für Privatpersonen

- Speziell für Köln: Wasser-Risiko-Check der Stadtentwässerungsbetriebe (StEB) Köln

- Überflutungsgefahrenkarten der StEB Köln

Current Information

Open access paper: Climate risk insurance and risk mitigation behavior

This study provides a comprehensive assessment of the factors associated with the separate use of climate risk insurance and home flood insurance and the reasons why people should take these two actions together. Contrary to the moral hazard hypothesis, purchasing...

Statement of the DKKV on mandatory natural hazard insurance as an element of precaution against climate risks

The consequences of global climate change are already being felt in Germany today. People in Germany are increasingly confronted with storm damage and, associated with this, increasing financial burdens. The flood disaster of 2021 and its consequences are a striking...